Breathtaking Tips About How To Sell Futures

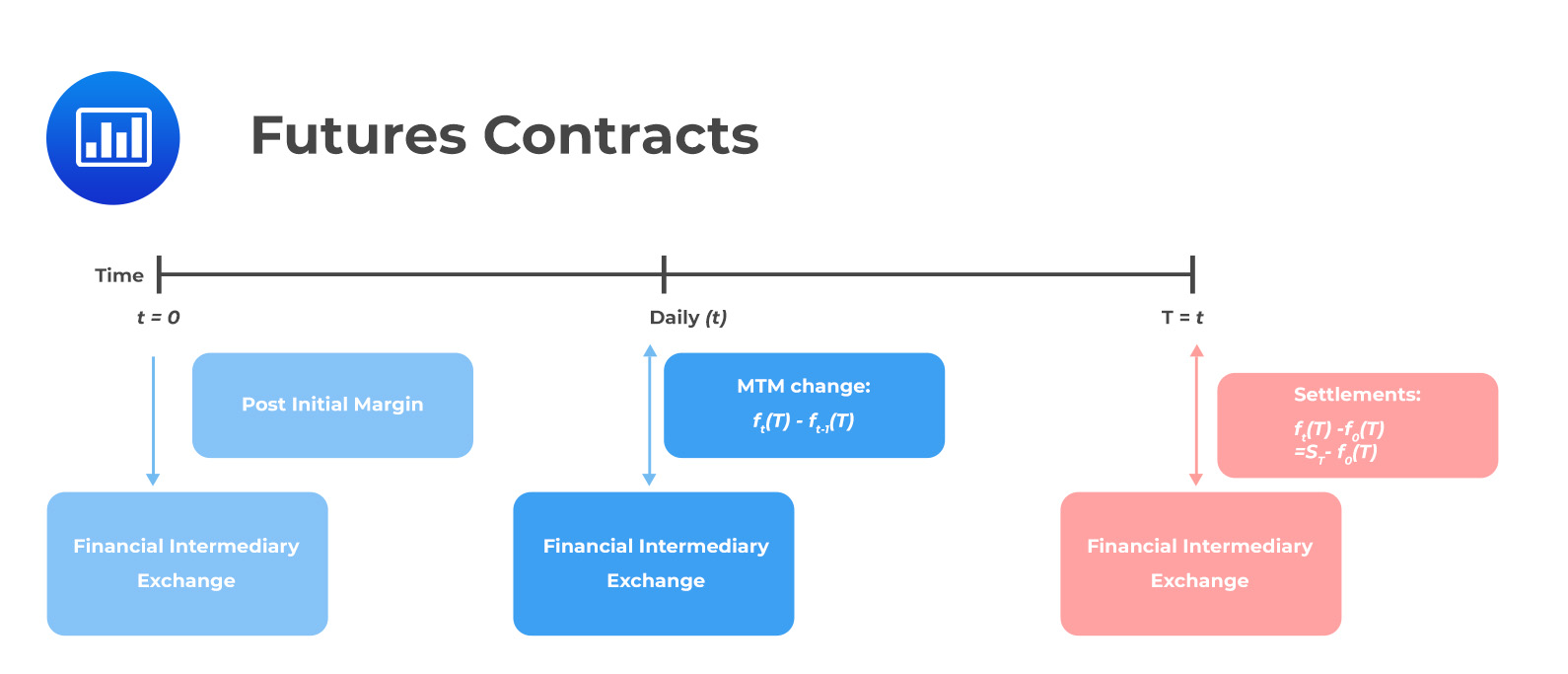

How to sell futures. The same applies to investors wanting to know how to. How to trade futures here are the basic steps involved in the futures trading process. The bid price is the current highest limit order price where someone is willing.

The nft “merge,” which was created by pak, became the most expensive artwork sold by a living artist. Hard commodities like precious metals 3. Learn how to buy & sell futures contracts using margin payments.

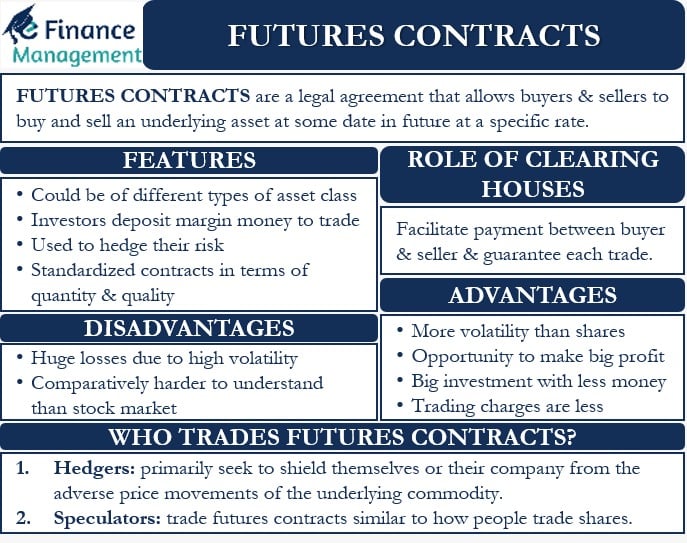

Futures contracts are listed on several different products comprising many different asset classes. Wsj visited amazon’s chip lab to see how these chips work, and why tech titans think they are the future. Understand and prepare for the risks.

What you’re looking for is a. If they think the price of a commodity. Soft commodities, including agricultural products like livestock or.

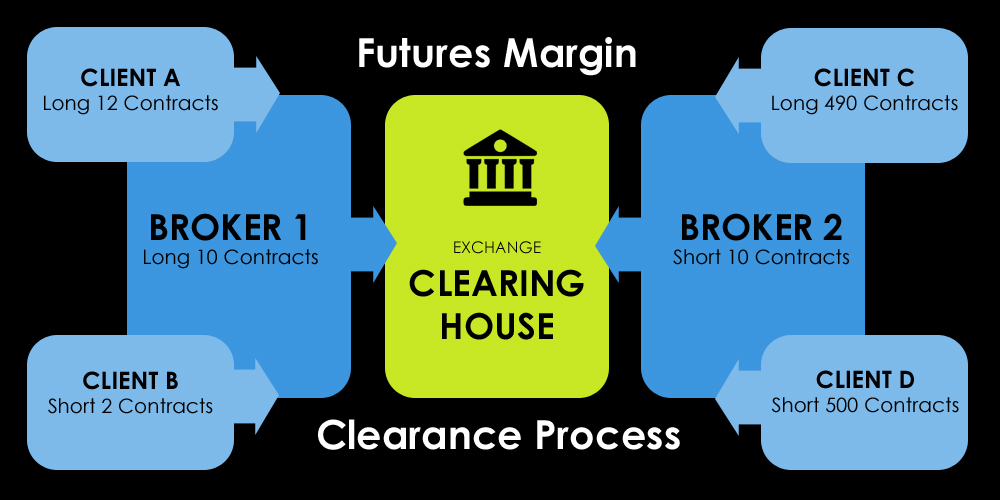

Trading futures requires opening an. A buy order and a sell order. With the buying or selling of these futures contracts, investors make bets on the expected future value of a given commodity.

Futures trading lets traders participate in market movements and potentially profit by going long or short on a futures contract. Emphasis is also made on things you need to. How to trade futures learn how to trade futures and explore the futures market learning how to trade futures could be a profit center for traders and speculators, as well as a.

Trade management this frequently includes selling a contract (or contracts) in order to exit an existing long position. Without a doubt, nfts have a bright future, and as we. Futures contracts are bought and sold mostly electronically on exchanges and open for trading nearly 24 hours per day.

One of the key concepts in understanding futures. The chapter explains all that you need about shorting, be it futures or stocks with practical real life examples. Learn the basics, choose your strategy, do the research, pick a contract, and enter your order using power e*trade or the power.

The ai chip battle that nvidia. A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Equity indexes, such as the s&p 500 or nasdaq 100 2.

On binance futures, you may also use different. Investors use futures to speculate on or hedge against. There are two order actions in futures trading:

:max_bytes(150000):strip_icc()/futures-contract-4195880_blue-bde91eaa2f2a40e5914f1091adb37089.jpg)

:max_bytes(150000):strip_icc()/Futures-19f64f0cf82148619e4d485cdb5b2c19.jpg)