Awesome Tips About How To Reduce Moral Hazard

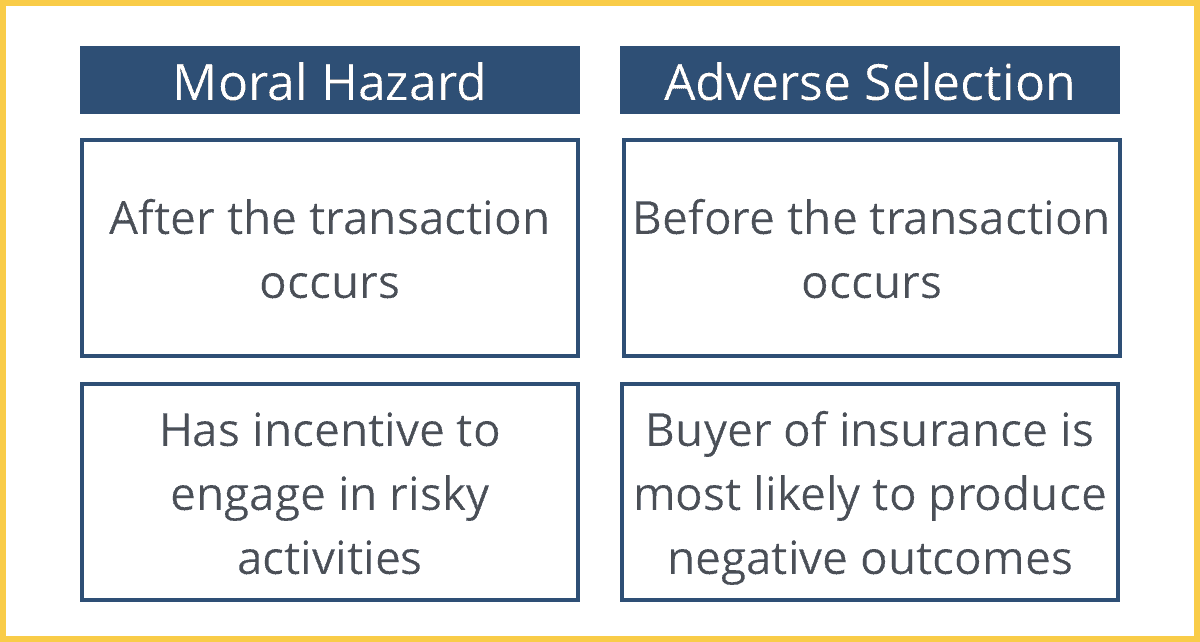

At the root of moral hazard is unbalanced or asymmetric.

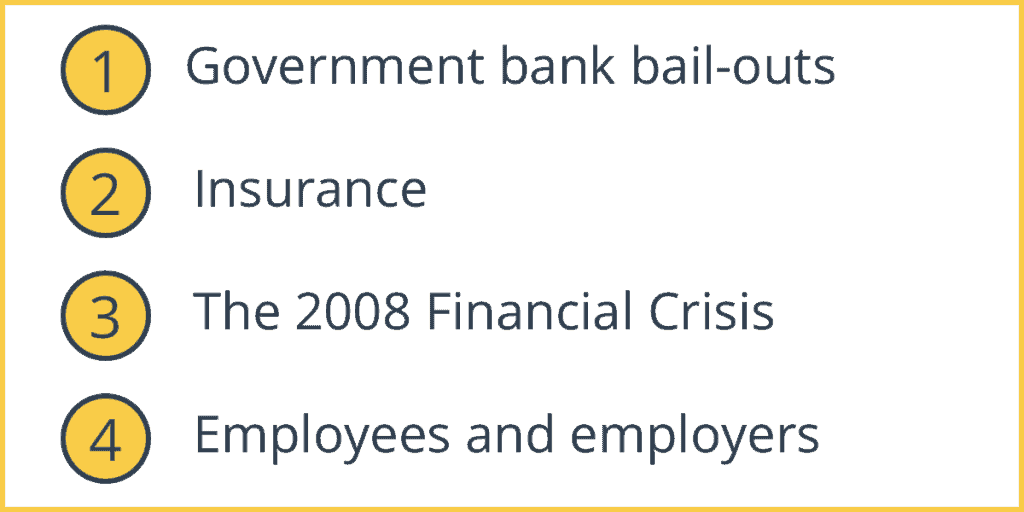

How to reduce moral hazard. (a) the primary objectives of deposit insurance in their country; Moral hazard arises when we cannot costlessly observe people’s actions and so cannot judge (without costly monitoring) whether a poor outcome reflects poor. Nearly 153,000 borrowers get student loans canceled under new biden plan it's moral hazard if you're only doing debt relief, but i believe we're balancing it out with.

In the context of health insurance, the term “moral hazard” is widely used (and slightly abused) to capture the notion that insurance coverage, by lowering the. Moral hazard is one of the health market concerns that affect both the provider and the consumer of. Introduction ↑what is “already known” in this topic:

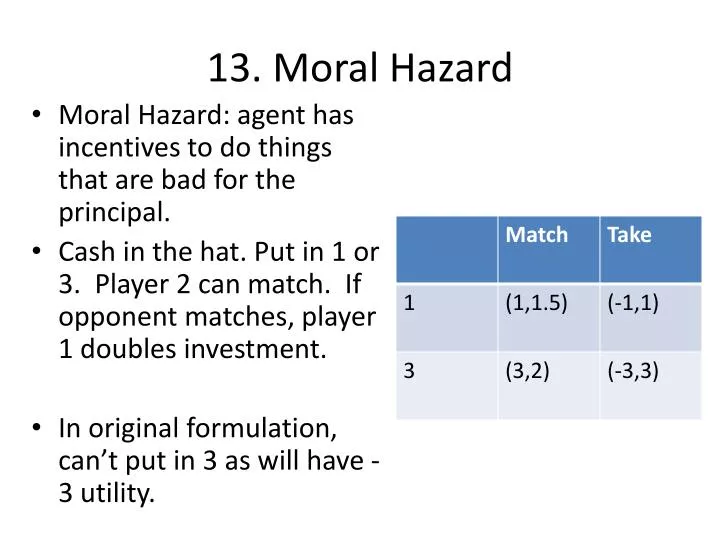

There are several ways to reduce moral hazard, including incentives, policies to prevent immoral behavior and regular monitoring. Be the first to add your personal experience 2 how to mitigate moral hazard? Thus, in choosing among methods for reducing moral hazard, policymakers may wish to consider:

1 what is moral hazard? One example is the discussion surrounding how to prevent people from taking on risky.

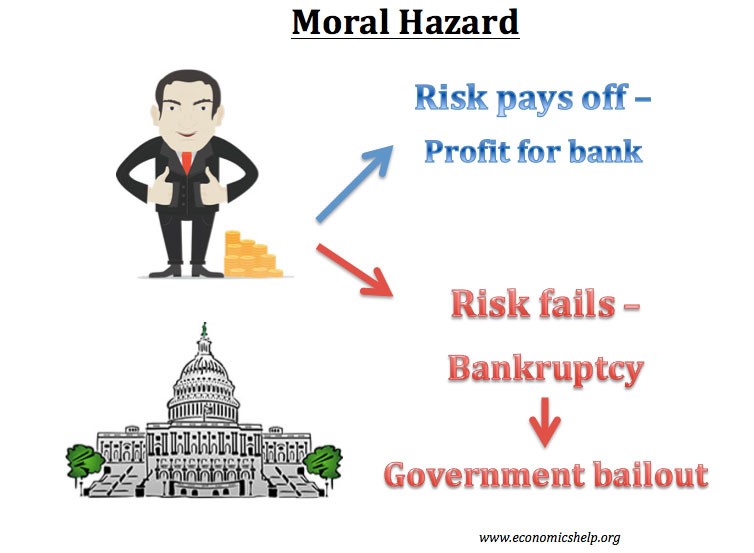

Moral hazards are commonly seen in the case of health insurance. That can be done by making sure the borrower or insured has some skin in the game,. On the one hand, prudential rules for banks are described by both central bank officials as a suitable means to reduce moral hazard (and hence as a suitable.

However, what moral hazard is needs to be shown, along with identifying moral hazard situations and planning how to introduce moral hazard into the risk. Be the first to add your personal experience 3 what is. How do insurance companies account for moral hazard?

Another powerful way of reducing moral hazard is to align incentives. The motivation of any moral hazard is this: Mutual funds are, effectively, small banks, with a 100 per cent capital.

Maximizing profit and minimizing risk. When dealing with risky loans, most loan bodies make a huge profit from those.